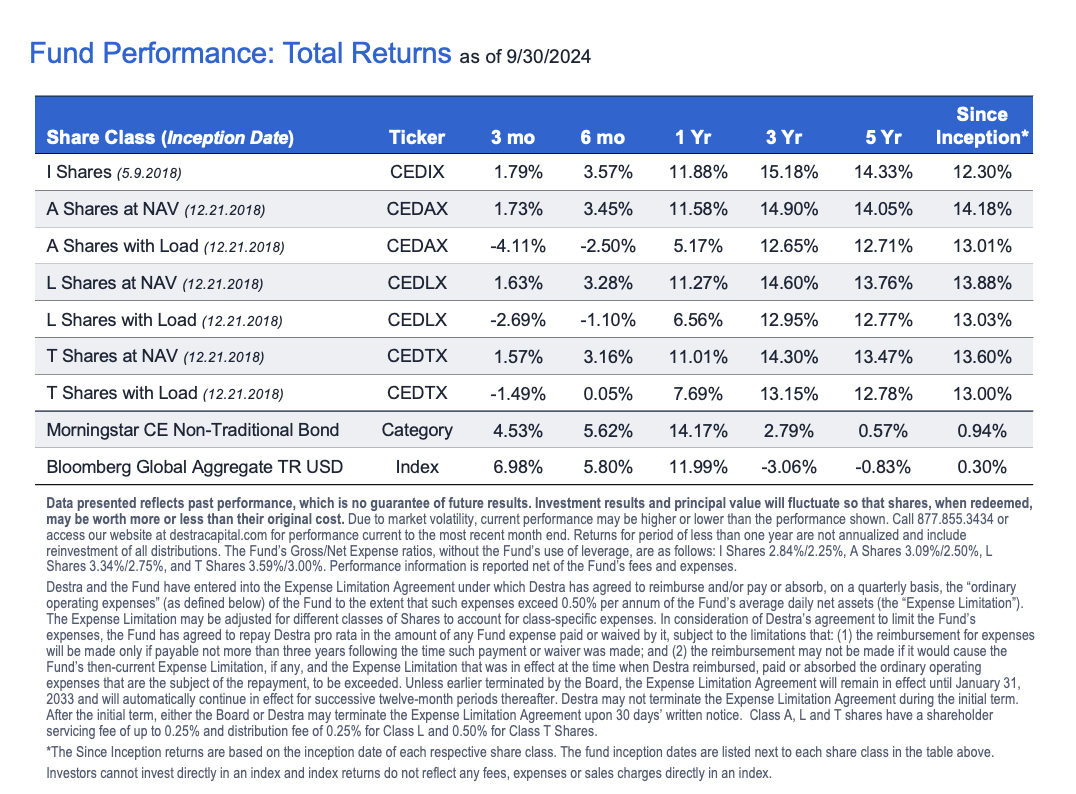

The BlueBay Destra International Event-Driven Credit Fund I Share Class (CEDIX) has been the top performing interval fund over the past 3 years, 5 years and since inception7 (15.18%, 14.33% and 12.30% annualized, respectively)

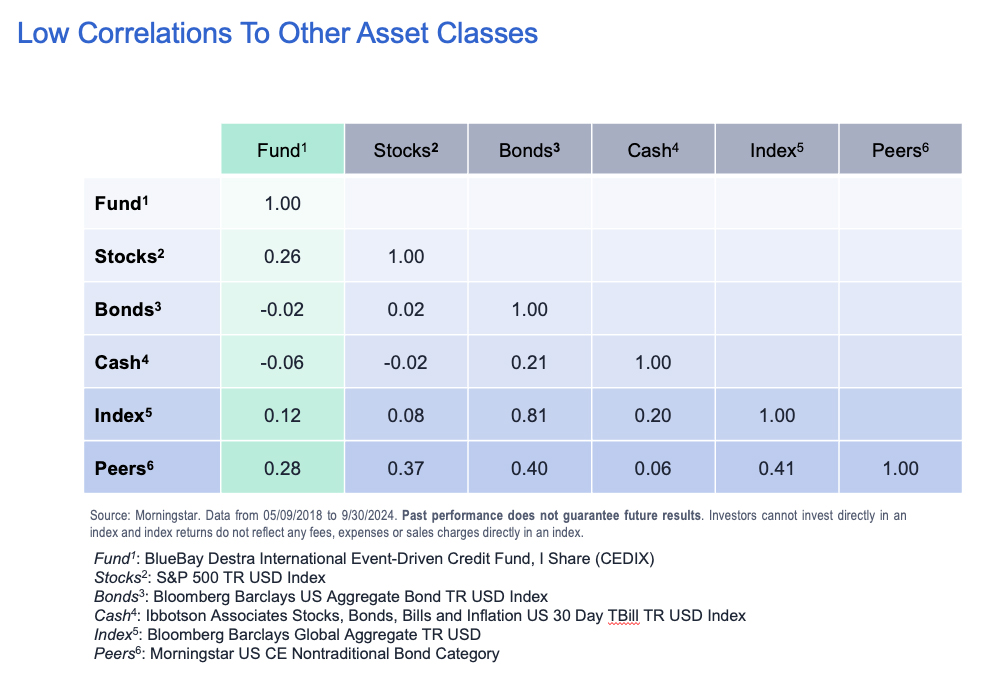

While the Fund boasts impressive returns over the time periods, it also may provide diversification based on its low correlation to other major asset classes such as Stocks2 (+0.26), Bonds3 (-0.02), and Cash4 (+0.28)

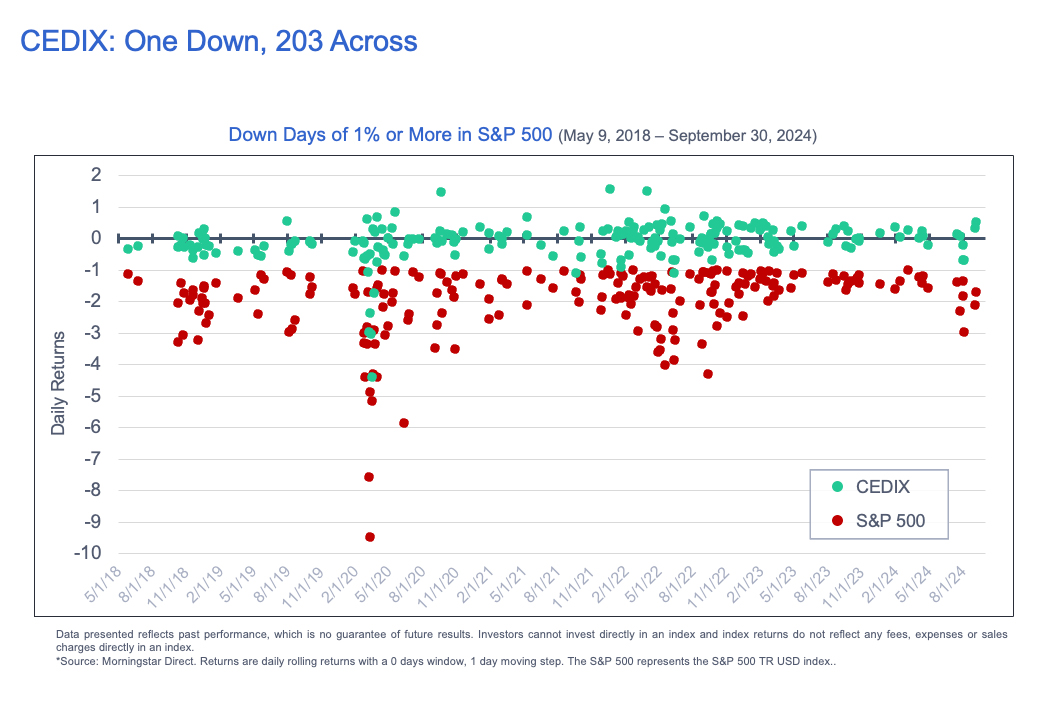

Since Inception of the Fund7, there have been 203 days where the S&P500 has gone down -1% or more. The cumulative return for the S&P500 on those days is -412.54% and the average down day is -2.03%. CEDIX experienced negative returns on only 111 of those days with a cumulative return of -22.59% and an average daily return of -0.11%.

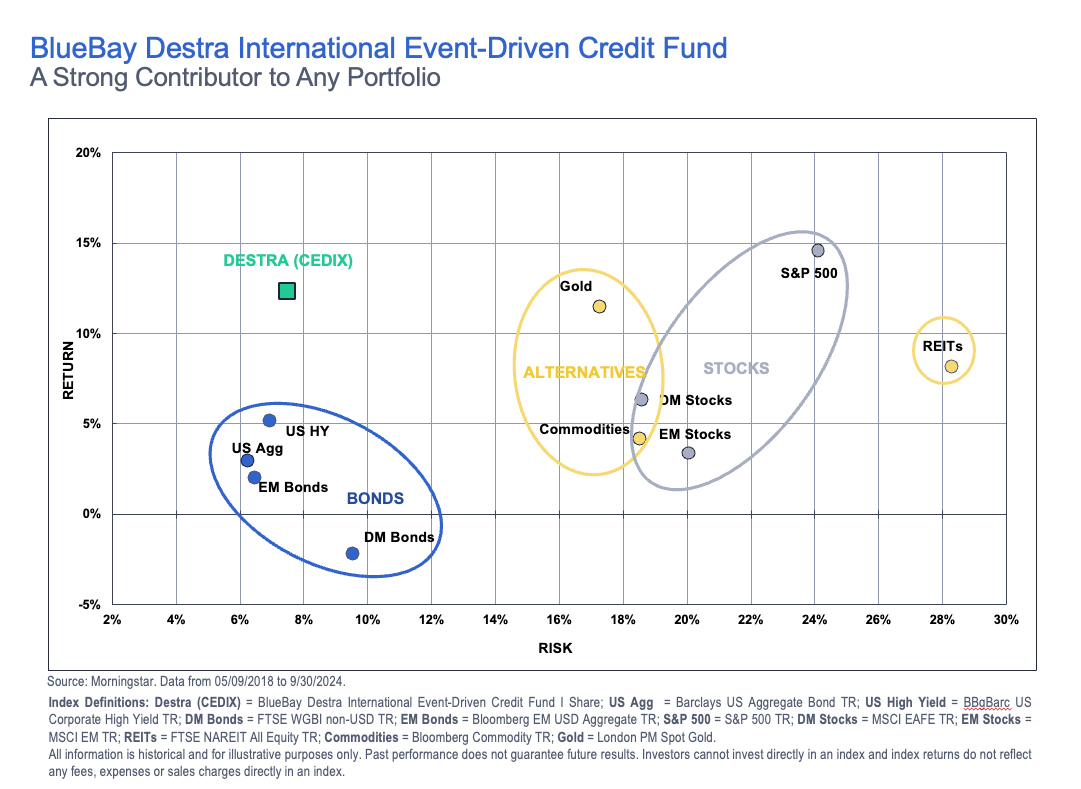

The Fund has delivered superior risk-adjusted returns to Stocks and Bonds since inception8. Elevate portfolios “Up” (returns) and “to the Left” (risk) with Event-Driven Credit.

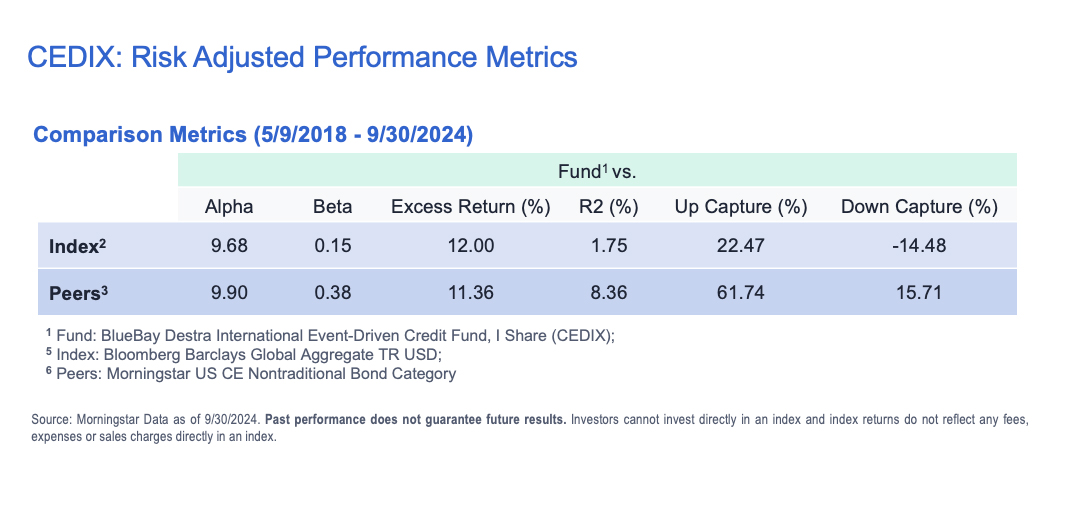

The Fund has produced nearly double digit alphas and double digit excess returns vs a global market reference index (Bloomberg Global Aggregate Bond TR Index) and its Morningstar Peers Category (US CE Nontraditional Bond).

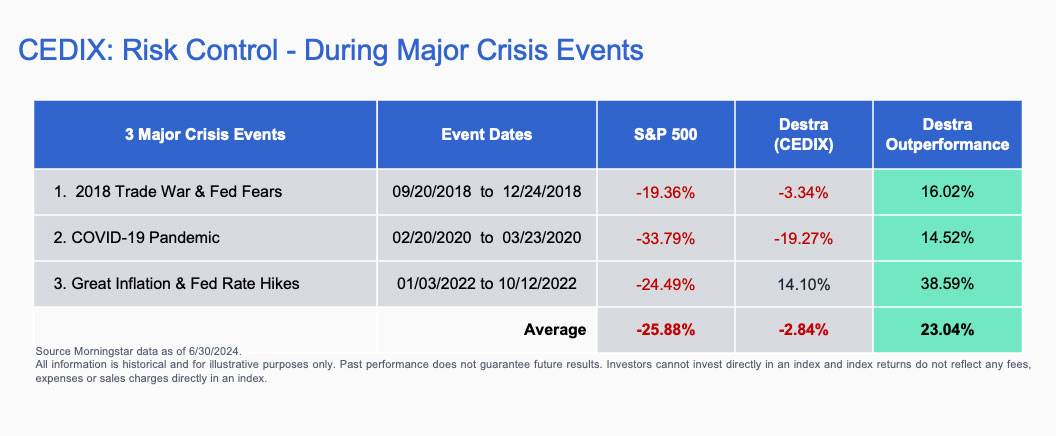

Since inception, CEDIX has demonstrated its ability to provide risk control during major crisis events in relation to the S&P 500 Index. During the 3 major stock market drawdown periods that the Fund has experienced, the S&P 500 average drawdown has been -25.88% vs CEDIX average drawdown of only -2.84%.

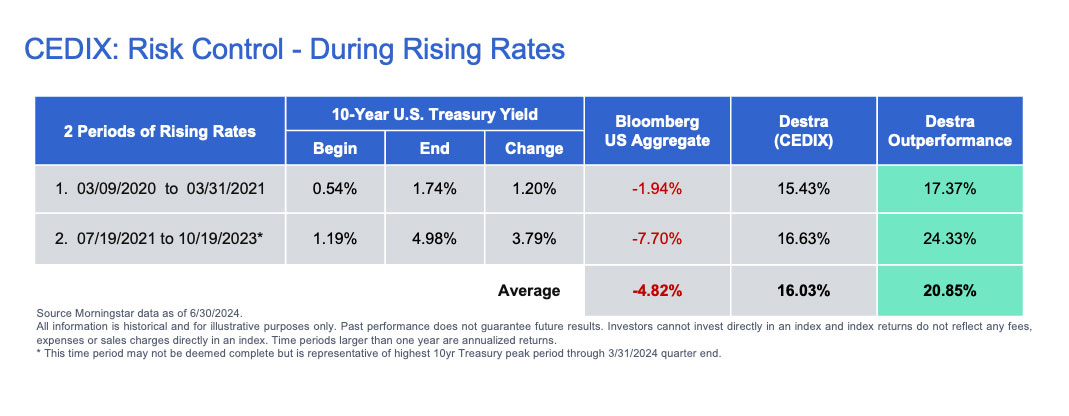

The Fund has also demonstrated its ability to control risk during periods of rising interest rates in relation to the Bloomberg Barclays US Aggregate Bond Index. During the two periods of 100+ bps increases in the 10 Yr Treasury Yield, the Agg has averaged a loss of -4.82% vs CEDIX average return of +16.03%.

Stormy Conditions Continue

A powerful confluence of factors is contributing to stormy conditions for markets in 2024, leading to events such as: geopolitical tensions, inflation, soaring energy costs, a cost of living crisis, and higher borrowing costs around the world.

By submitting your contact information, you will receive a link to a whitepaper titled “What’s So Special about Special Situations?” written by Adam Phillips, the Head of BlueBay’s Developed Market Special Situations team at RBC Global Asset Management and Portfolio Manager for the BlueBay Destra International Event-Driven Credit Fund.