Hot Bond Bull Summer

Destra Capital

August 5, 2024Wow, July was hot. Temperatures were up all across the US but the real heat was in the bond markets, where yields wanted to come down, investors were certain Powell promised them a September cut, and nothing could dissuade the bond bulls of summer from pushing prices higher.

Destra Credit Strategies Indicator

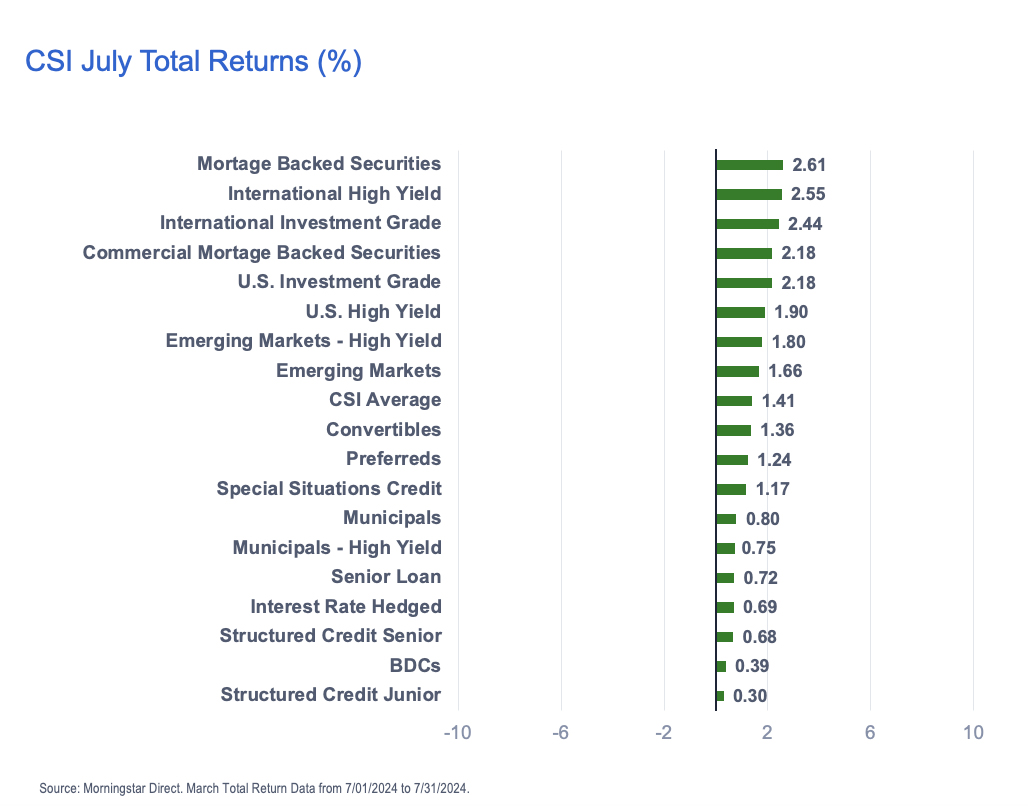

For July, Destra’s Credit Strategies Indicator (“CSI”) was all green! All 18 categories in the CSI were positive on a total return basis in July.

The average for the CSI was a positive +1.41% for the month, with Mortgage Backed Securities investing strategies having the biggest move, up +2.61. They were followed by International High Yield strategies, up +2.55% and International Investment Grade, up +2.44%.

Investors Chase The Bond Bull

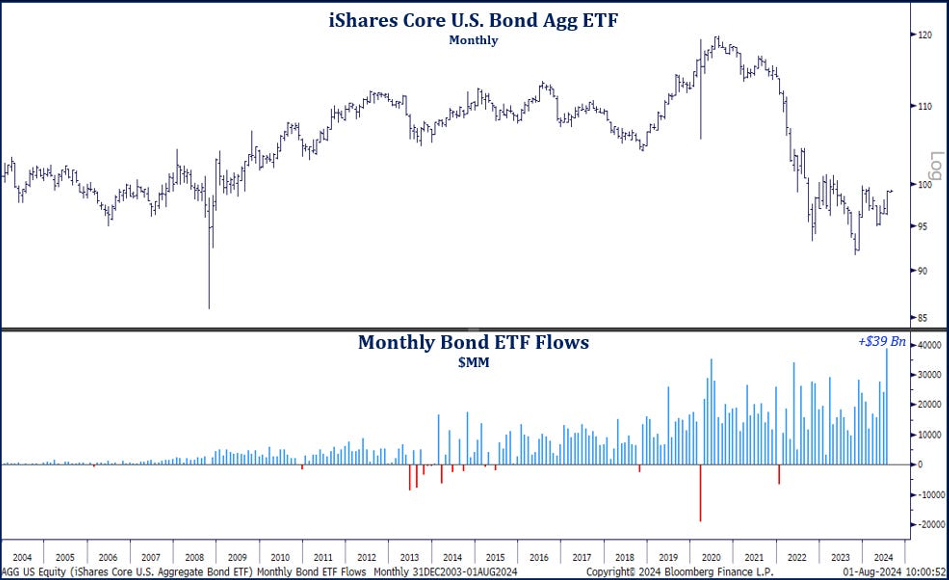

All those great returns had investors chasing bonds. According to the team at Strategas, “Bond funds saw inflows of roughly $39 billion in July, the most on record.”

Is That A Nervous Smile, Credit?

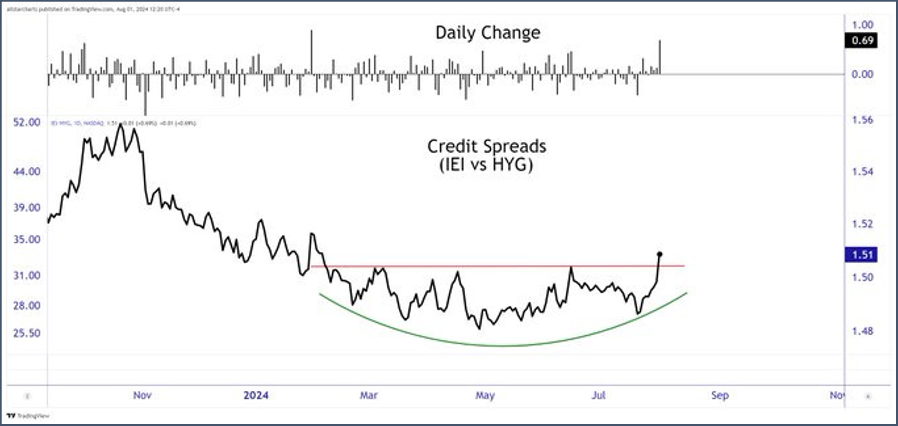

Yet, while credit strategies were delivering positive results in July, Steven Strazza called out the huge move in credit spreads to end the months in an X post. “I have no idea what to make of today’s price action… but, I do know that this is how bad things begin…Credit spreads making a big move today. Biggest daily spike since January. Hitting highest level since February. *$IEI $HYG is a crude measure for credit spreads.”

Bankruptcies Hit Decade High

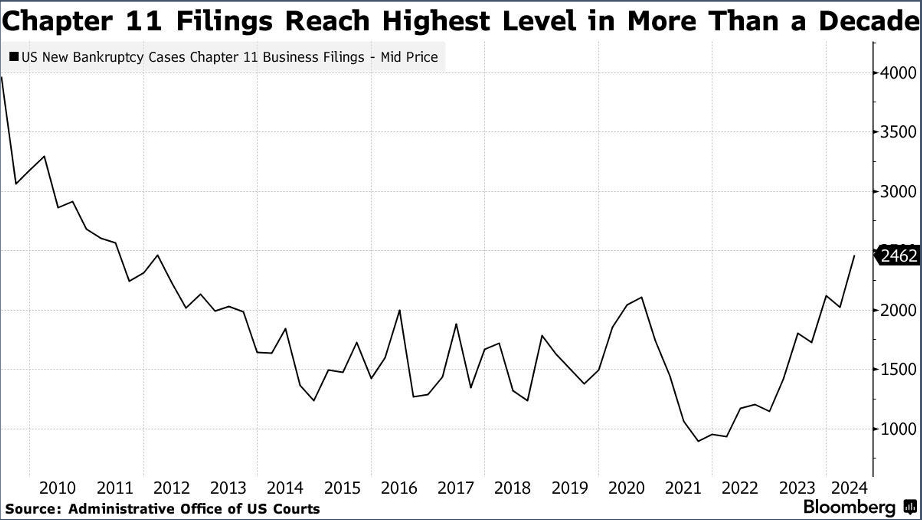

And Bloomberg sported a disturbing graphic at month’s end as well, showing that Chapter 11 bankruptcy filings had hit a decade high.

Widening credit spreads and soaring bankruptcies are not the market indicators you really want when investing, except perhaps if you are Special Situations investor. The Special Situations Credit strategy was up +1.17% in July, putting the year to date returns for that category at over +6%.

Is The Bull in Bonds Over?

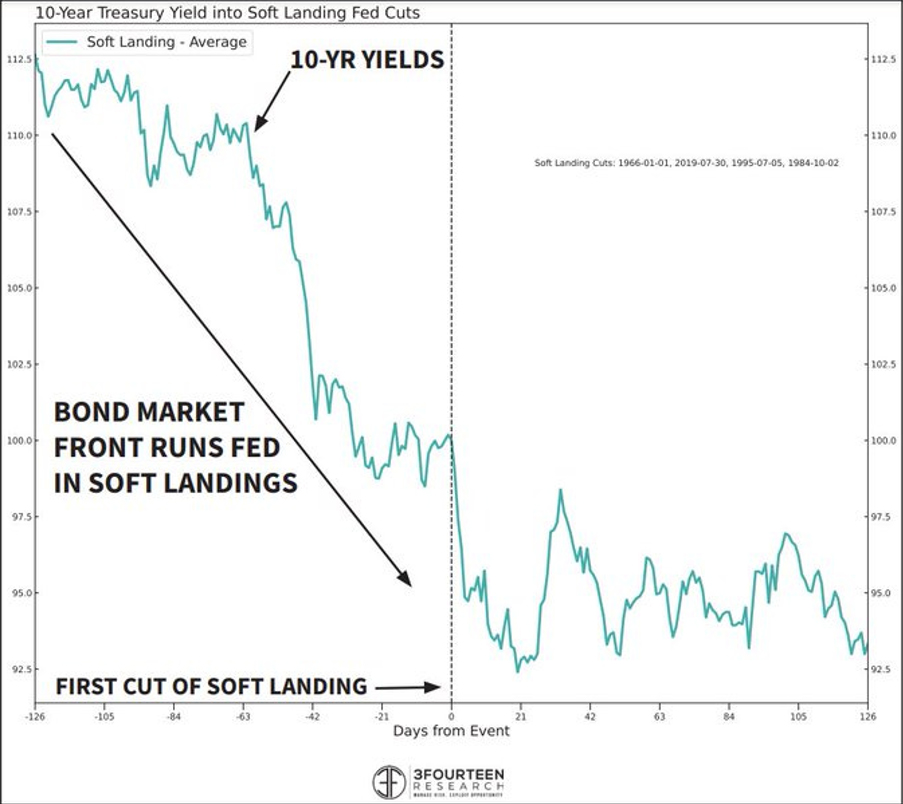

Warren Pies of 3Fourteen Research had an interesting chart on X (formerly Twitter) this week. “Remember: In soft landings, the majority of the move in yields comes in anticipation of the first Fed cut.”

10 Under 4

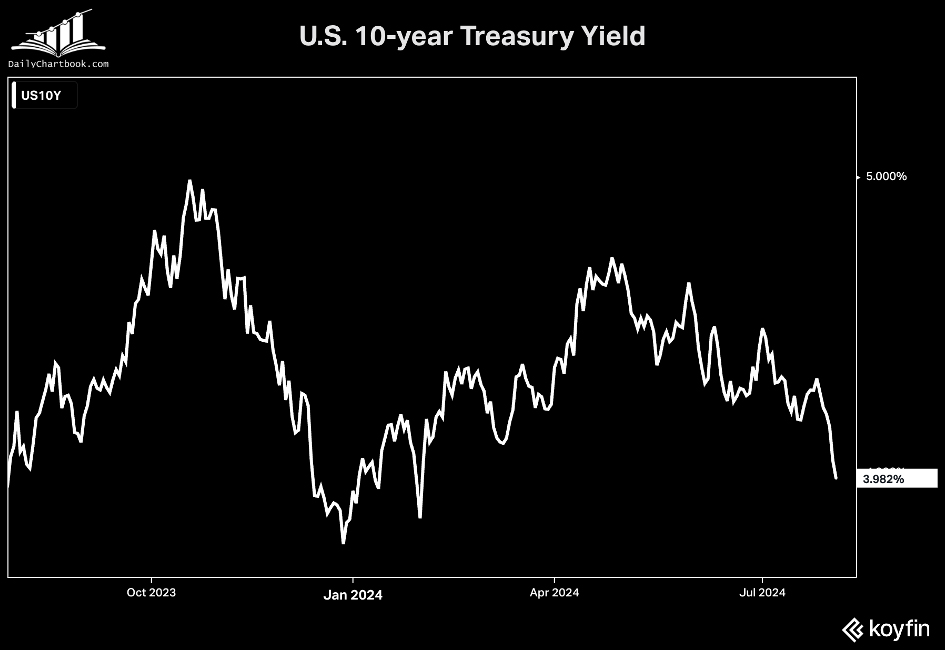

And the market is certainly “anticipating” a cut from the Fed. The DailyChartBook.com showed that … “The yield on the US 10-year Treasury fell below 4% today (July 31st) for the first time since February.”

Domo Arigato, Mr. Roboto

As of this morning (Monday, August 5, 2024) the equity markets are collapsing around the globe with Japan down a staggering 12% today! US equity markets look to collapse on the open and yields are cratering. Maybe the Hot Bond Bull Summer has more room to run?

Regardless, remember your sunscreen out there.