you are leaving Destracapital.com

It is important to note that by clicking on this link you will be leaving this website and any information viewed there is not the property of Destra Capital Investments LLC.

BlueBay Destra International Event-Driven Credit Fund

A continuously offered Closed-End Interval Fund

A Shares

|

I Shares

|

L Shares

|

T Shares

|

Portfolio Managers

BlueBay Event-Driven Credit team at RBC BlueBay Asset ManagementThe BlueBay Event-Driven Credit team at RBC BlueBay Asset Management (“RBC BlueBay”) invests in a diverse portfolio of opportunities comprising liquid stressed, distressed, and special situation investments in the global leveraged loan and high yield markets. RBC BlueBay is part of RBC Global Asset Management, and is the asset management division of Royal Bank of Canada (RBC) in EMEA & APAC and a provider of global investment management services and solutions to institutional and wholesale investors through separate accounts, pooled funds, hedge funds, and specialty investment strategies. RBC BlueBay offers specialist fixed income strategies via its BlueBay Fixed Income platform, as well as broad-based equity capabilities, an integrated ESG approach and impact investing strategies. Investment TeamAdam Phillips Duncan Farley |

Investment Objective

The Fund’s investment objective is to provide attractive total returns, consisting of income and capital appreciation.

Investment Strategy and Philosophy

The Fund invests in credit related instruments and/or investments considered by the Fund to have the potential to provide a high level of total return. Credit related instruments include:

- Bonds

- Debt securities

- Loans issued by various U.S. and non-U.S. public- or private-sector entities

- Derivatives

- Cash equivalents

Investment Process

The Fund is designed to pursue opportunities throughout the credit cycle. The Fund is a continuously offered, closed-end interval fund, that seeks to provide long-term investors the potential for:

1 |

Total return opportunities from select event-driven credit |

2 |

Professional management from BlueBay, a premier global credit manager |

Event-Driven Credit: What is it?

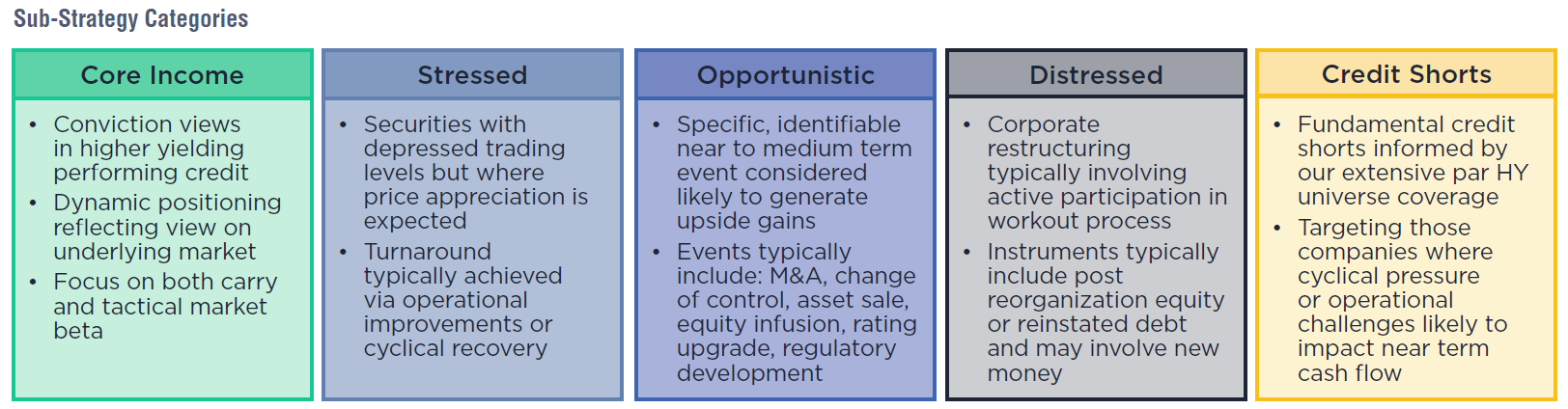

Events are happening all the time to corporations and other entities, that are reflected in the market prices of their securities. To the skilled credit analyst, some of these events may translate into investment opportunities. Below is a partial list and description of “events” that BlueBay evaluates daily around the globe.

Performance

Quarterly

as of 9/30/24

| Ticker | Share Class (Inception Date) | 3 Mo | YTD | 1 Yr | 3 Yr | Since Inception |

|---|---|---|---|---|---|---|

| CEDAX | A Shares at NAV (12/21/18) | 1.73 | 9.52 | 11.58 | 14.90 | 14.18 |

| CEDAX | A Shares (12/21/18) | -4.11 | 3.24 | 5.17 | 12.65 | 13.01 |

| CEDIX | I Shares (5/9/18) | 1.79 | 9.75 | 11.88 | 15.18 | 12.30 |

| CEDLX | L Shares (12/21/18) | -2.69 | 4.64 | 6.56 | 12.95 | 13.03 |

| CEDTX | T Shares (12/21/18) | 1.57 | 9.06 | 11.01 | 14.30 | 13.60 |

Monthly

as of 10/31/24

| Ticker | Share Class (Inception Date) | 3 Mo | YTD | 1 Yr | 3 Yr | Since Inception |

|---|---|---|---|---|---|---|

| CEDAX | A Shares at NAV (12/21/18) | -1.20 | 9.15 | 11.84 | 14.57 | 13.89 |

| CEDAX | A Shares (12/21/18) | -6.88 | 2.89 | 5.41 | 12.33 | 12.75 |

| CEDIX | I Shares (5/9/18) | -1.10 | 9.42 | 12.13 | 14.87 | 12.08 |

| CEDLX | L Shares (12/21/18) | -5.43 | 4.33 | 6.83 | 12.66 | 12.77 |

| CEDTX | T Shares (12/21/18) | -1.29 | 8.69 | 11.26 | 14.00 | 13.32 |

Data presented reflects past performance, which is no guarantee of future results. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, current performance may be higher or lower than the performance shown. Call 877.855.3434 or access our website at destracapital.com for performance current to the most recent month end.

Returns for period of less than one year are not annualized, and include reinvestment of all distributions. The Fund’s Gross/Net Expense ratios, without the Fund’s use of leverage, are as follows: I Shares 3.00%/2.26%, A Shares 3.25%/2.51%, L Shares 3.50%/2.76%, and T Shares 3.75%/3.01%. Performance information is reported net of the Fund’s fees and expenses.

Destra and the Fund have entered into the Expense Limitation Agreement under which Destra has agreed to reimburse and/or pay or absorb, on a quarterly basis, the “ordinary operating expenses” (as defined below) of the Fund to the extent that such expenses exceed 0.50% per annum of the Fund’s average daily net assets (the “Expense Limitation”). The Expense Limitation may be adjusted for different classes of Shares to account for class-specific expenses. In consideration of Destra’s agreement to limit the Fund’s expenses, the Fund has agreed to repay Destra pro rata in the amount of any Fund expense paid or waived by it, subject to the limitations that: (1) the reimbursement for expenses will be made only if payable not more than three years following the time such payment or waiver was made; and (2) the reimbursement may not be made if it would cause the Fund’s then-current Expense Limitation, if any, and the Expense Limitation that was in effect at the time when Destra reimbursed, paid or absorbed the ordinary operating expenses that are the subject of the repayment, to be exceeded. Unless earlier terminated by the Board, the Expense Limitation Agreement will remain in effect until February 13, 2031, and will automatically continue in effect for successive twelve-month periods thereafter. Destra may not terminate the Expense Limitation Agreement during the initial term. After the initial term, either the Board or Destra may terminate the Expense Limitation Agreement upon 30 days’ written notice. Class A, L and T shares have a shareholder servicing fee of up to 0.25% and distribution fee of 0.25% for Class L and 0.50% for Class T Shares.

Current Distribution

as of 9/27/2024

| Ticker | Amount | Record Date | Ex-Date | Payable Date |

|---|---|---|---|---|

| CEDAX | 0.3089 | 9/26/24 | 9/27/24 | 9/30/24 |

| CEDIX | 0.3234 | 9/26/24 | 9/27/24 | 9/30/24 |

| CEDLX | 0.2857 | 9/26/24 | 9/27/24 | 9/30/24 |

| CEDTX | 0.2787 | 9/26/24 | 9/27/24 | 9/30/24 |

Click Here to see a complete listing of historical distributions.

Past performance is no guarantee of future results.

Portfolio Characteristics

|

as of 9/30/24

|

|||||||||||||||||||||

Sub-Strategy Breakdownas of 9/30/24 |

|

||||||||||||||||||||

Top 10 Countriesas of 9/30/24 Top 10 Issuersas of 9/30/24

All data is as of 9/30/2024. Percent of Total Managed Assets including Cash. Data is subject to change on a daily basis. Totals may not equal 100% due to rounding. There is no assurance that the investment process will lead to successful investing. |

|

||||||||||||||||||||

Literature

Regulatory Documents

Fund Forms

Podcasts

Section 19(a) Notices

News

Glossary

Risks

Because of the risks associated with investing in high-yield securities, an investment in the Fund should be considered speculative. Investors should consider the investment objective and policies, risk considerations, charges and ongoing expenses of an investment carefully before investing. The prospectus contains this and other information relevant to an investment in the fund. Please read the prospectus or summary prospectus carefully before you invest or send money. To obtain a prospectus, please contact your investment representative or Destra Capital Investments LLC at 877.855.3434

Past Performance is no indication of future results. An investment in the Fund involves a high degree of risk. In particular: The Fund’s shares will not be listed on an exchange in the foreseeable future, if at all. It is not anticipated that a secondary market for the shares will develop and an investment in the Fund is not suitable for investors who may need the money they invest within a specified timeframe. The Fund is suitable only for investors who can bear the risks associated with the Fund’s limited liquidity and should be viewed as a long-term investment.The amount of distributions that the Fund may pay, if any, is uncertain.The Fund may pay distributions in significant part from sources that may not be available in the future and that are unrelated to the Fund’s performance, such as a return of capital, borrowings or expense reimbursements and waivers.

Summary of Investment Strategy. Under normal market conditions, the Fund will invest at least 80% of its total assets (including borrowings for investment purposes) in credit related instruments and/or investments that have similar economic characteristics as credit related instruments that are considered by the Fund to have the potential to provide a high level of total return. Credit related instruments include bonds, debt securities and loans issued by various U.S. and non-U.S. public- or private-sector entities, including issuers in emerging markets, derivatives and cash equivalents. There is no limit on the credit quality, duration or maturity of any investment in the Fund’s portfolio. Under normal market conditions, the Fund will invest at least 40% of its total assets in securities of non-U.S. issuers.

The Event-Driven Credit strategy focuses on investing in securities of companies facing a corporate, market or regulatory event. The goal is to identify securities with a favorable risk-reward ratio based on the likely outcome, as a result of such event occurring. Such events include, but are not limited to, corporate events, such as restructurings, spin-offs, mergers and tender offers; significant litigation; initial and seasoned debt/equity offerings; launches of new products; regulatory changes; analysts meetings; earnings announcements; covenant issues; bankruptcies; corporate reorganizations; shareholder activism; and significant management and external changes that dramatically change the company’s profit margins. Opportunities are created by the reluctance of traditional investors to assume the risk associated with certain corporate, market or regulatory events.

The Event-Driven Credit strategy will focus on investing in long and short positions of debt (fixed or floating rate bonds and loans) or equity securities, including exchange-traded funds (“ETFs”), preferred stock, warrants, and options on these securities, depositary receipts such as American Depositary Receipts (ADRs), and derivatives such as futures and options on futures. These investments may be traded over-the-counter or on an exchange. The Fund may invest in issuers of any size, and in U.S. and non-U.S. issuers. Under normal market conditions, the Fund’s investments in equity securities, at the time of investment, will be limited to 20% of its total assets.

There is no currency limitation on securities acquired by the Fund. The Fund uses the market value of its derivative contracts for the purposes of its 80% investment policy in credit related instruments.

For a further discussion of the Fund’s principal investment strategies, see “Investment Objective, Opportunities and Strategies.”