What is Special Situations Credit Investing?

Destra Capital

April 15, 2024Special Situations Credit investing is a sophisticated institutional strategy focusing on unique credit opportunities in companies facing stress, distress, restructuring, bankruptcy, or other dislocations. The strategy, often referred to as Event-Driven Credit, involves targeting an identified “event” or catalyst that has the potential to unlock value.

Such events include, but are not limited to, corporate events, such as restructurings, spin-offs, mergers and tender offers; significant litigation; initial and seasoned debt/equity offerings; launches of new products; regulatory changes; analyst meetings; earnings announcements; covenant issues; bankruptcies; corporate reorganizations; shareholder activism; and significant management and external changes that dramatically change the company’s profit margins.

What are the benefits of Special Situations Credit strategies?

Special Situations Credit strategies may offer several key benefits, including:

- Uncorrelated Returns: These strategies often exhibit low correlations with traditional equity, fixed-income, and other alternative assets. The underlying investments are driven by idiosyncratic, company-specific events rather than broader market movements. Consequently, portfolios tend to be less sensitive to economic cycles or downturns, potentially enhancing portfolio diversification, offering more stable returns, or outperforming during uncertain economic conditions.

- Asymmetric Risk/Reward Profile: Special situations credit investments may offer mispriced assets or mispriced risk, where the potential upside outweighs the downside risk due to market inefficiencies or temporary dislocations. Thorough fundamental analysis and risk assessment are crucial for identifying opportunities with favorable outcomes that significantly exceed potential losses. This asymmetry may enhance portfolio returns while potentially mitigating downside risk.

- Active Management and Expertise: Special situation credit investing requires specialized knowledge and expertise to identify, analyze, and capitalize on unique investment opportunities. A skilled investment team adept at navigating complex credit situations through an actively managed approach is crucial for successfully integrating this strategy into a portfolio.

How does Special Situations Credit fit in a portfolio?

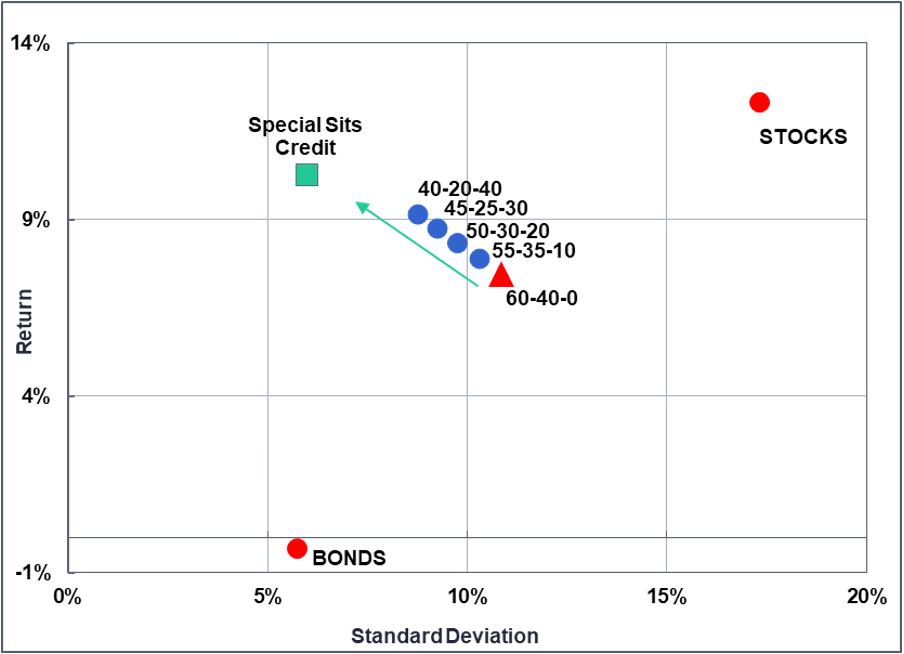

Destra and RBC BlueBay believe that a Special Situations Credit strategy could be a core alternative and a strong contributor in nearly any portfolio. Using the Efficient Frontier framework, we plotted the risk/return profile of simple traditional portfolio concepts in RED (100% Stocks, 60% Stocks/40% Bonds, 100% Bonds) compared to portfolios with increasing allocations to Special Situations Credit added to the traditional 60/40 portfolio mix in Blue (10%, 20%, 30%, 40%).

| Traditional Portfolios | Special Sits Portfolios |

| 100% Stocks | 55% Stocks/35% Bonds/10% Special Sits Credit |

| 60% Stocks/40% Bonds | 50% Stocks/30% Bonds/20% Special Sits Credit |

| 100% Bonds | 45% Stocks/25% Bonds/30% Special Sits Credit |

| 40% Stocks/20% Bonds/40% Special Sits Credit |

The 5-year risk and return chart below shows dramatically elevated risk-adjusted returns as the allocation to Special Situations Credit increased. We believe this illustrates the strategy’s effectiveness as a diversifier to a traditional portfolio of stocks and bonds.

Source: Morningstar. 5-Year Annualized Return Data from 1/01/2019 to 12/31/2023. All information is historical and for illustrative purposes only. Past performance does not guarantee future results.

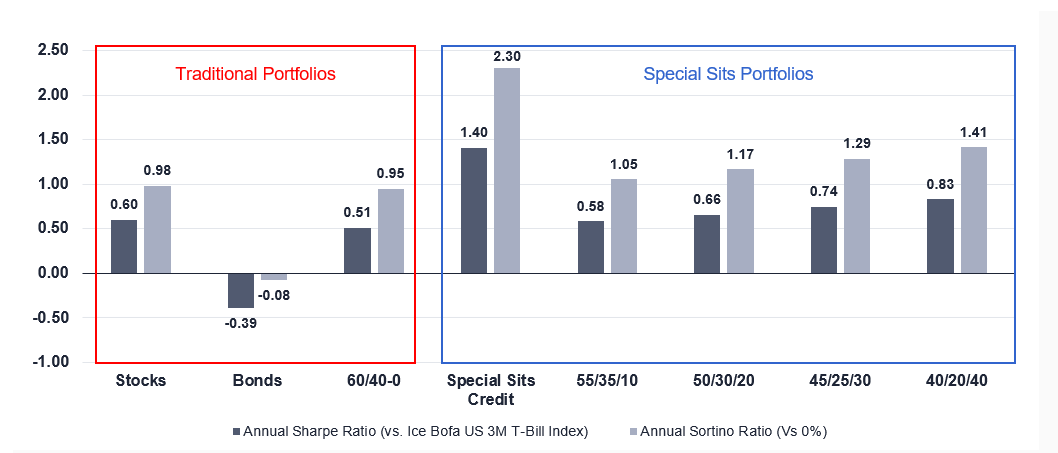

The Sharpe and Sortino Ratio chart below demonstrate Special Situations Credit’s potential value in a diversified portfolio. The Sharpe ratio measures the average return earned over the risk-free rate per unit of volatility, while the Sortino ratio is similar but focuses only on downside volatility. When comparing Special Situations Credit, the Special Sits Portfolios, and Traditional Portfolios, the Sharpe and Sortino Ratios increase commensurately with each incremental weighting to Special Situations Credit, further emphasizing the potential value of incorporating Special Situations Credit into a diversified investment portfolio.

Source: Morningstar. 5-Year Annualized Return Data from 1/01/2019 to 12/31/2023. All information is historical and for illustrative purposes only. Past Performance does not guarantee future results.

As the allocation to Special Situations Credit increases from 10% to 40%, the portfolios demonstrate improved risk-adjusted returns, suggesting that the unique characteristics of Special Situations Credit investments can enhance the overall efficiency of the portfolio. The low correlation of Special Situations Credit strategies with traditional asset classes, combined with the potential for asymmetric risk/reward profiles, contributes to this improvement in risk-adjusted performance.

The past 5 years is a relatively short time period, but investable vehicles for the broader public have really only been available over this time period. Prior to the increased development of interval and tender offer funds, only “hedge funds” and similar private fund vehicles were available that deployed this strategy in a dedicated way. While the time frame is limited, the analysis provided by Destra highlights the potential benefits of including Special Situations Credit as a core alternative investment in a diversified portfolio. By allocating a portion of any portfolio to a Special Sits strategy, investors may be able to capitalize on unique credit opportunities while potentially enhancing risk-adjusted returns and diversification.

Methodology: Different allocations of MSCI ACWI GR, Bloomberg Global Aggregate Bond TR, and the

custom Special Situations Credit strategy indicator*.

The allocations as pictured in the above two charts were assembled as follows:

Individual Holdings

Bonds = Bloomberg Global Aggregate Bond TR

Stocks = MSCI ACWI GR

Special Sits Credit= Special Situations Credit Strategy Indicator*

Allocations without Special Situations Credit

STOCKS = 100% Stocks, 0% Bonds

60-40 = 60% Stocks, 40% Bonds

BONDS = 0% Stocks, 100% Bonds

Allocations with Special Sits Credit

55-35-10 = 55% Stocks, 35% Bonds, 10% Special Sits Credit

50-30-20 = 50% Stocks, 30% Bonds, 20% Special Sits Credit

45-25-30 = 45% Stocks, 25% Bonds, 30% Special Sits Credit

40-20-40 = 40% Stocks, 20% Bonds, 40% Special Sits Credit

Special Sits Credit = 0% Stocks, 0% Bonds, 100% Special Sits Credit

What are the risks of Special Situations Credit strategies?

Special Situation Credit opportunities are created by the reluctance of traditional investors to assume the risk associated with certain corporate, market or regulatory events.

Such investment opportunities may require more time for the investment thesis to materialize than trading “on the run” fixed income investments. As such, Special Situations investing often entails capital commitments with liquidity restrictions. Additionally, special situations occur much more commonly in highly leveraged firms that are almost certainly considered non-investment grade by credit rating agencies. Frequently, these companies and their debt may be downgraded when they face these situations and therefore investing in them may be considered very speculative. Liquidity risks, credit risks and default are significant elements of Special Situations / Event-Driven Credit investing and you should investigate these and other risks carefully before considering committing capital (see a summary of potential risks at the bottom of this article).

Why Special Situations Credit Now?

Destra and RBC BlueBay view special situations credit as an evergreen approach to investing; however, in the current higher interest rate and volatile economic & geopolitical environment, both Destra and RBC BlueBay believe there may be an accelerating opportunity set for the foreseeable future.

To learn more about how Special Situations Credit strategies may help elevate your portfolio construction process, please give us a call at 877-855-3434 or visit our website at www.destracapital.com.

Risks and Other Important Considerations

This material is being provided for informational purposes only. The author’s assessments do not constitute investment research and the views expressed are not intended to be and should not be relied upon as investment advice. This blog and the statements contained herein do not constitute an invitation, recommendation, and solicitation or offer to subscribe for, sell or purchase any securities, investments, products or services. The opinions are based on market conditions as of the date of writing and are subject to change without notice. No obligation is undertaken to update any information, data or material contained herein. The reader should not assume that all securities or sectors identified and discussed were or will be profitable.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. THERE IS NO GUARANTEE THAT ANY FORECASTS MADE WILL COME TO PASS. DUE TO VARIOUS RISKS AND UNCERTAINTIES, ACTUAL EVENTS, RESULTS OR PERFORMANCE MAY DIFFER MATERIALLY FROM THOSE REFLECTED OR CONTEMPLATED IN ANY FORWARD-LOOKING STATEMENTS. THERE CAN BE NO ASSURANCE THAT ANY INVESTMENT PRODUCT OR STRATEGY WILL ACHIEVE ITS OBJECTIVES, GENERATE PROFITS OR AVOID LOSSES. DIVERSIFICATION DOES NOT ENSURE PROFIT OR PROTECT AGAINST LOSS IN A POSITIVE OR DECLINING MARKET.

All investments carry a certain degree of risk including the possible loss of principal. Complex or alternative strategies may not be suitable for everyone and the value of any portfolio will fluctuate based on the value of the underlying securities.

There are substantial risks and conflicts of interests associated with Credit, Event-Driven, Special Situations and Stressed investments, and you should only invest risk capital. Special situation investments are speculative and involve a substantial degree of risk. The level of analytical sophistication, both financial and legal, necessary for successful investment in distressed assets is unusually high. Therefore, the strategy will be particularly dependent on the analytical abilities of the Advisers. In any reorganization or liquidation proceeding relating to a company in which a strategy invests, the strategy may lose its entire investment, may be required to accept cash or securities with a value less than the original investment and/or may be required to accept payment over an extended period of time. Generally, the success of an event-driven strategy depends on the success of the prediction of whether the anticipated corporate event occurs or a successful outcome is achieved as a result of the event. Investing in or seeking exposure to companies in anticipation of an event carries the risk that the event may not happen or may take considerable time to unfold, it may happen in modified or conditional form, or the market may react differently than expected for the event, in which case the strategy may experience loss or fail to achieve a desired rate of return. Special Situations strategies may be subject to substantial charges for management and advisory fees. Past results are not necessarily indicative of future results. Mutual funds involve risk including possible loss of principal. An investment in an alternatives strategy mutual fund should only be made after careful study of the prospectus, including the description of the objectives, principal risks, charges, and expenses of the fund.

Notes to Hypothetical Portfolio Performance

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE OF AN INVESTMENT WILL FLUCTUATE, THEREFORE, YOU MAY HAVE A GAIN OR LOSS WHEN YOU LIQUIDATE AN INVESTMENT. PRIOR YEAR AND YEAR TO DATE PERFORMANCE NUMBERS ARE NOT INDEPENDENTLY VERIFIED, AND ARE SUBJECT TO CHANGE, UNTIL COMPLETION OF AN AUDIT. THERE ARE SUBSTANTIAL RISKS ASSOCIATED WITH AN INVESTMENT IN SPECIAL SITUATIONS, AS SUMMARIZED ELSEWHERE IN THIS BLOG.

The historical hypothetical portfolio performance for the Special Situations Credit strategy is composed of 5 Funds, including the FS Credit Income Fund (FCRIX), the Virtus Westchester Credit Event Fund (WCFIX), the BlueBay Destra International Event-Driven Credit Fund (CEDIX), the Lord Abbett Special Situations Income Fund (LISSX), and the Opportunistic Credit Interval Fund (SOFIX). Inception Dates for each of the Funds, respectively, are 11/1/2017 ; 1/1/2018 ; 5/09/2018 ; 9/12/2021 ; and 7/5/2022. The custom reference strategy uses an equal weighting of underlying fund returns net of all fees & expenses for track records where the underlying Funds were live. No hypothetical back tested returns were used, only historical return data. Equal weightings were rebalanced quarterly. The historical hypothetical portfolio performance for the 60/40 portfolio uses actual benchmark returns for the given portfolio construction percentages with a monthly rebalance: 60% MSCI ACWI TR Index; 40% Bloomberg Global Aggregate Bond Index. The historical hypothetical portfolio performance information for the Special Situations and 60/40 portfolios have been obtained or derived from sources believed by Destra Capital Advisors, LLC to be reliable, but Destra does not make any representation or warranty, express or implied, as to the information’s accuracy or completeness, nor does Destra recommend that the information herein serve as the basis of any investment decision or trading program.

This blog is solely intended for informational purposes and does not constitute an offer or solicitation of an offer, or any advice or recommendation, to purchase any securities or other financial instruments.

Index Descriptions and Risks

It is not possible to invest directly in any index or benchmark. Indices and benchmarks do not reflect commissions or fees that might be charged to a similar investment product if actually acquired. Such commissions or fees are likely to materially affect the performance data presented by an index or benchmark. The following indices have been used in the presentation for informational and illustrative purposes only.

60/40 Portfolio: Hypothetical portfolio constructed as follows using actual benchmark returns. 60% MSCI ACWI Index; 40% Bloomberg Global Aggregate Bond Index; rebalanced monthly

MSCI ACWI Index – measures the equity market performance of the world’s developed and emerging markets.

Bloomberg Global Aggregate Bond TR Index - measures performance of the global developed investment grade government and corporate bond market.

*Special Situations Credit Strategy indicator: The Special Situations Credit strategy indicator is composed of 5 Funds, including the FS Credit Income Fund (FCRIX), the Virtus Westchester Credit Event Fund (WCFIX), the BlueBay Destra International Event-Driven Credit Fund (CEDIX), the Lord Abbett Special Situations Income Fund (LISSX), and the Opportunistic Credit Interval Fund (SOFIX). Inception Dates for each of the Funds, respectively, are 11/1/2017 ; 1/1/2018 ; 5/09/2018 ; 9/12/2021 ; and 7/5/2022. The custom reference strategy uses an equal weighting of underlying fund returns net of all fees & expenses for track records where the underlying Funds were live. No hypothetical back tested returns were used, only historical return data. Equal weightings were rebalanced quarterly.